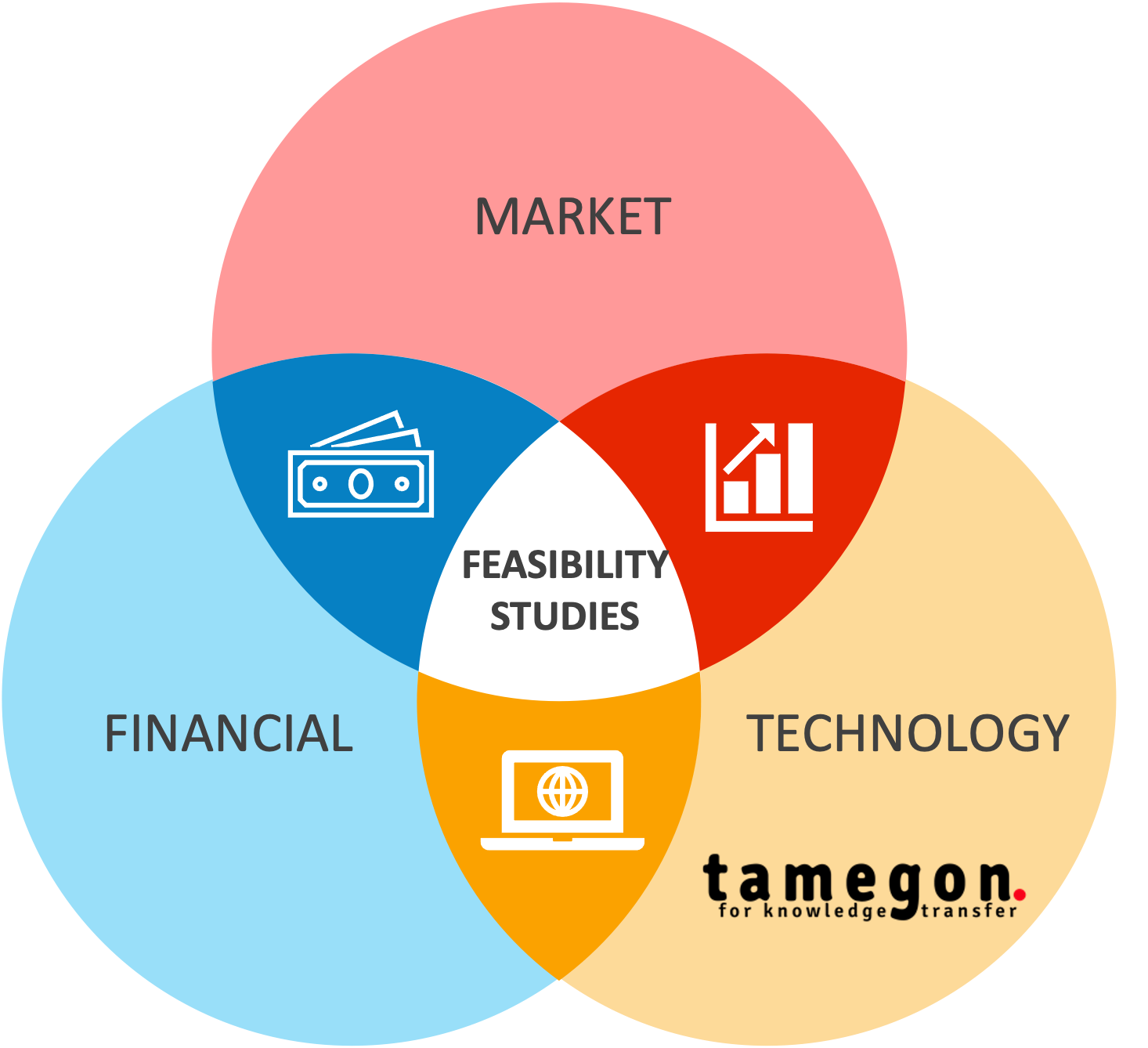

Feasibility Studies

We validate product, technology, and business propositions de-risking investments and developing robust business plans.

It all starts with a great idea, but prior to making any investment in technology, expanding into new markets or launching a new business it is crucial to validate it:

- study and understand all aspects of the project, concept, technology, or business idea,

- determine whether it is viable and the projected return on investment is sufficient to satisfy all stakeholders,

- develop a robust business and financial plan, and

- identify potential risks and ways to mitigate them.

We assist our clients to produce or validate business cases to establish support for innovation commercialisation. While conducting feasibility studies we put emphasis on collecting relevant data stemming from primary and secondary market research with the view to build sufficient evidence to justify product or business model assumptions and financial projections and identify early on any potential barriers to entry.

Our

market feasibility studies

aim to define and understand the potential customer of the product or service, their specific needs that the proposition satisfies and include current and future market potential in addition to market and competitors' products analyses.

During our technology feasibility studies we access experts in relevant fields to provide opinions of the technology under review; our studies include

- Establishing any conflicting IP ownership issues,

- Checking previous disclosure and background prior art,

- Review of potential applications and markets with the view to establish whether it is a platform technology,

- Identifying requirements for further development and expected costs,

- Ascertaining potential routes to market and if appropriate, possible licensees.

As part of our technology feasibility studies we work with out clients to closely understand the TRL and CRL levels informing their commercialisation plans and actions. To find out more about our TRL and CRL innovation tool click here.

Based on market research and in depth understanding of the business environment, our financial feasibility studies include the identification of required CAPEX and OPEX investments, development of cashflow projections, identification of possible timescales to achieve positive cash flows and the desired return on investment.

Our commercialisation feasibility studies aim to explore, establish, and advise on appropriate routes to market including licensing and start-up formation.

To learn more, contact us today.

Establishing a New Higher Education Institution - Feasibility Studies

We study national and international markets, pedagogical models, and possible operating models developing specific recommendations and detailed financial plans for the launch of new universities and Higher Education Institutions, addressing investment challenges for private investors and governments and ensuring that the vision of all stakeholders is fulfilled.

According to data from the United Nations Educational, Scientific and Cultural Organisation (UNESCO), there has been a significant increase in the number of universities worldwide over the past few decades. Although the number of new universities and HEIs founded each year tends to be small, compared to the number of existing universities worldwide, in 2021, there were over 26,000 universities globally, compared to around 13,000 in 1995. Similar data reported by the World Bank indicates that the number of tertiary education institutions worldwide increased from approximately 20,000 in 2010 to nearly 26,000 in 2021. This includes all types of higher education institutions, such as universities, colleges, and technical institutes.

The number of universities founded in a given year is influenced by a range of factors, such as economic and political conditions, demographics and demand for higher education in specific regions as well as government policies. For example, the majority of new universities founded globally in 2020 were located in Asia and Africa, as reported by UNESCO. According to Deloitte reports, due to significant increase in government education spending in specific regions, such as China, India, and Asia in general, a number of new universities have been established and existing universities have been expanded, particularly in STEM fields.

Establishing a new university can be a significant financial undertaking, with costs often run into the tens or even hundreds of millions of dollars. In addition to direct financial costs, there may also be indirect costs associated with establishing a new university, such as the need for infrastructure development, faculty recruitment and training, and ongoing operational expenses. The

amount of investment

required to establish a new university can depend on factors such as the cost of land, construction, equipment, faculty salaries, and ongoing operational expenses as well as the model that a university chooses to operate by. The total required investment in new universities will also depend on location, size, and type of institution, as well as the available funding sources and the specific goals and objectives of the university. In some cases, new universities may be funded by

governments

or other

public entities, while in other cases they may be established with

private investment. Some new universities may also rely on a

combination of public and private funding sources.

To ensure that the vision of the founders and investors and all stakeholders of the new university is fulfilled and understood from the outset, a detailed feasibility study is of paramount importance. Such feasibility study aims to address the questions of

- why a new university or HEI is needed in this location,

- what subjects should the new entity offer,

- who would be the ideal student for such organisation,

- what is the best pedagogical model that the university should employ to fulfil its ambitions and role in society,

- what is the total investment required until it achieves positive cash flows,

- what income sources should the university build from the start,

- how will the university attract and retain the most appropriate academic staff,

- how is it going to kick-start research and commercialise research outputs.

We have been involved in the development of many feasibility studies for launching new universities in the Middle East and Europe advising private investors on the potential investment required to achieve their vision and a sustainable future. As part of the feasibility studies we develop financial scenarios considering several student populations, various educational programmes, and educational affiliations and partnerships to ensure quality of academic provision. We further consider diversified revenue sources for the start-up universities to ensure a sustainable future that meets the three missions that any university should fulfil, namely teaching, research, and service to the community through technology transfer and IP commercialisation for societal benefit.

To learn more, contact us today.

Interested in validating your new business proposition and investment?

We are here to help!

Contact us to discuss how our feasibility studies can allow you to de-risk your investment propositions and gain useful insights across several areas including markets, technologies, and finance.