Technology & Commercialisation Readiness Levels

Use our Technology Readiness Level (TRL) and Commercialisation Readiness Level (CRL) tool to identify and review the current status of your organisation's innovation activities, make plans, and identify actions to fully commercialise your products or services.

Determine your product's or service's TRL and CRL

Identify areas for further development

Gain useful insights

Design actions

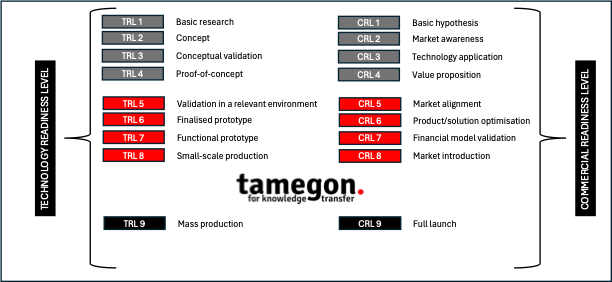

The Technology Readiness Level (TRL) scale was originally defined by NASA in the 1990’s

as a mean for measuring or indicating the maturity of a given technology, from a paper sketch to its entry into the market . Typically, new technologies go through the various stages of the TRL scale in their life cycle. During the research and development phases, it is possible to have iterations among the different TRL levels. In this sense, the TRL scale also helps to evaluate the project progress towards launching a product or service.

However, focusing solely on the TRL framework might lead to a misalignment of technology achievements and commercial requirements, especially when innovation leaders have strong technical backgrounds. For this reason, we propose that for the innovation assessment of a business the Commercial Readiness Level (CRL) is also used, alongside the TRL, to mitigate technical and commercial risks and optimise plans and returns. The CRL, like the TRL, is critical for determining and measuring organisational maturity towards commercialisation.

TRL's emphasis on technological maturity, combined with CRL's assessments of market readiness and economic viability, enables organisations to develop robust commercialisation plans that propel them forward. Experience suggests that TRL and CRL are interdependent and that CRL should be equal or higher than TRL; the commercialisation risk is significantly reduced when TRL and CRL are about 5.

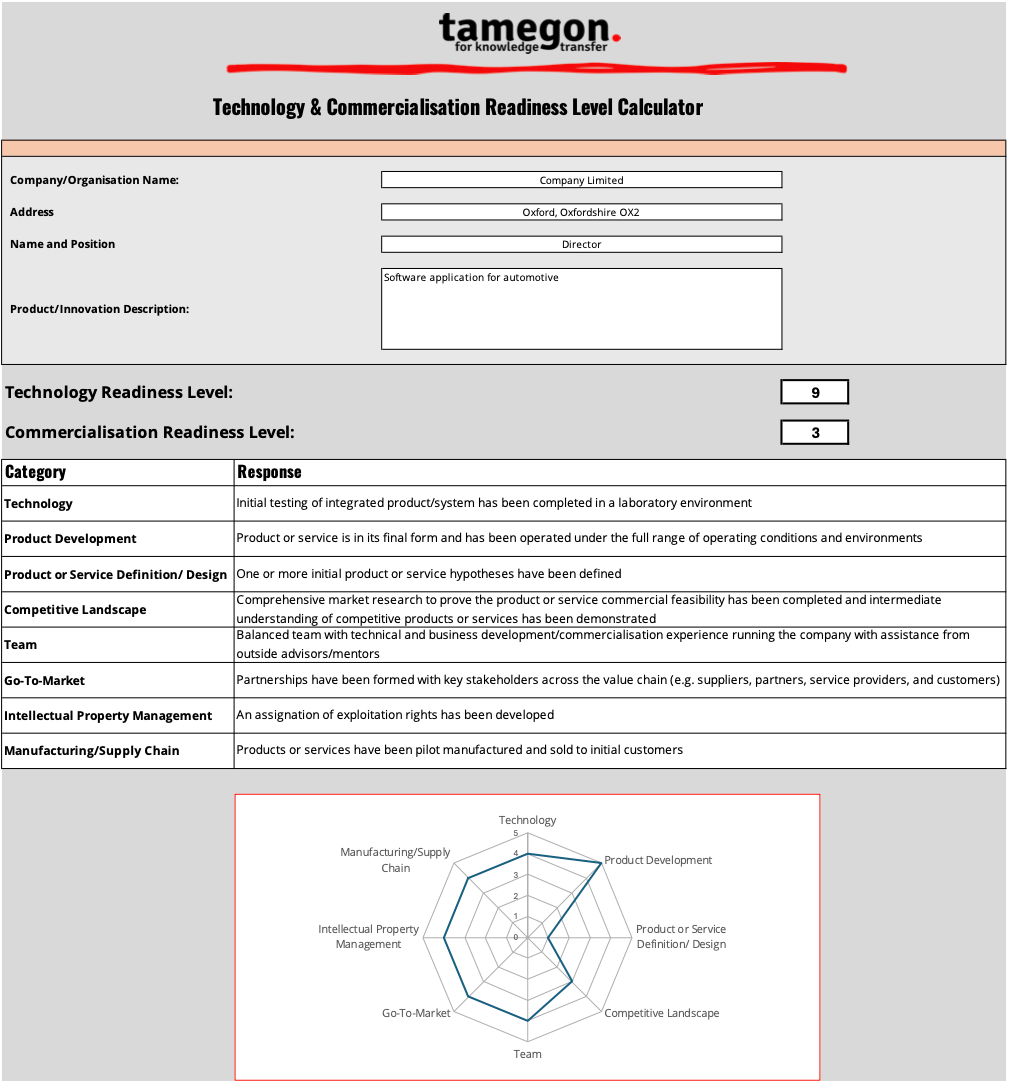

Our TRL/CRL tool (the output of which is shown in the picture below) allows organisations to gain a good appreciation of their current status of product and service development, develop actions and create detailed commercialisation plans following our 7Ps of Commercialisation framework.

The CRL assessment refers to establishing whether the product or service is ready to be taken as a commercial offering to the market targeting specific customer segments. CRL assessment includes the following topics:

- Product/Solution Fit - Is the product or service solving a real need? And is it the right time to bring the solution to market?

- Vision/Team Fit – Does the business have assembled an experienced team to bring the product or service to market? What are its strengths?

- Product/Market Fit – Is there a willingness from consumers to pay to solve the problem or need? How are the target customers currently solving the problem and will they be willing to switch to the business’s product or service?

- Intellectual Property – Is there any relevant intellectual property (IP), patents or licenses involved with the proposed product or service solution? If the product or service solution requires access to platform IP or an enabling technology in the private domain, what plans exist for securing access?

- Market/Business Model Fit – Is the market opportunity big enough to make this business model sustainable? Will the business be able to achieve a substantial market share?

Building on the TRL and CRL levels and evaluation of a product or service development, we use our "7Ps of Commercialisation" tool, shown in the adjacent schematic, to develop an all-encompassing commercialisation plan covering the broad topics of

- People – experience, leadership, and networks

- Plan – mission and vision of the company, ambitions, and strategy and plans for growth

- Product – clear plans for the development and introduction of products or services, required performance, customer base, and pipeline of opportunities

- Profit – cash, turnover, profitability desired, cashflow model, sales growth

- Production – supply chain and quality control

- Protection – IP protection, trademarks, knowhow, external partnerships and contacts

- Promotion

– distribution, endorsements, marketing messages and positioning, competition and differentiation.

To help emerging and growing companies to determine the level of technical and commercial maturity of their product or

service innovations, we use our diagnostic tool comprising

8 categories, as shown below

The determination of the TRL and CRL levels inform the feasibility study that we conduct on behalf of our clients. To find out more about our technology feasibility studies, please click here.

Interested in improving your commercialisation activities?

We are here to help!

Contact us to discuss how our TRL and CRL tool can allow you to gain useful insights unlocking your innovation projects potential.